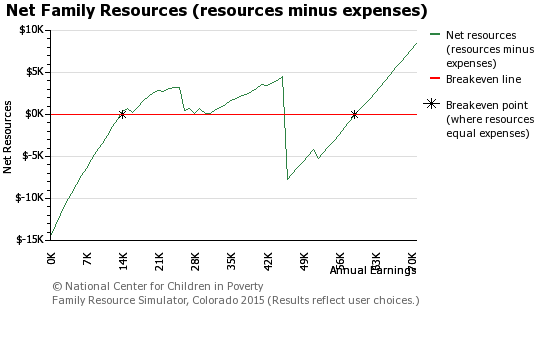

The Family Resource Simulator (FRS) calculates a family's net resources over a range of earning levels.

Net Resources = Family resources (earnings, tax credits, and public benefits) - family basic expenses (child care, food, medical costs, rent, taxes paid, etc.)

FRS users can determine the annual earnings families need to afford their basic necessities (i.e., their net resources are greater than 0) and when families will hit a benefit cliff (i.e., a small increase in earnings leads to the loss of eligibility for public benefits, making a family worse off).

This graph, one of several that appear on the 'Results' screen in Step 8, shows FRS sample results. It shows how net resources change as annual earnings rise for a single-parent Denver family with two children (ages 3 and 6), who, when income eligible, receives SNAP, Medicaid/CHIP, CCDF child care subsidies, TANF, LIHEAP, and federal and state tax credits.

EXAMPLE FOR FAMILY IN COLORADO

This tool is intended for advocates, researchers, policymakers, and other government officials. For FRS-based tools intended for direct service providers and individual families, please click here. The Basic Needs Budget Calculator (BNBC) shows how much it takes for families to afford minimum daily necessities.

Quick Results

Contact

For more information about the Family Resource Simulator, or if you work for an organization interested in helping us develop or update a simulator for your state, please contact:

Seth Hartig

Project Director, Family Resource Simulator

T: 212-961-3353

E: hartig@nccp.org

Heather Koball

Co-Director, National Center for Children in Poverty

Bank Street Graduate School of Education

E: koball@nccp.org

Internal Resources