State Policy Choices to Promote Asset Development

Individual Development Accounts

| State-supported IDA program in operation1 | | Yes |

State Choices to Promote Asset Protection

| Assets disregarded for eligibility determination3 | | No ($2,000)2 |

| Assets disregarded for Medicaid eligibility4 | | Yes |

| Assets disregarded for SCHIP (separate program) eligibility3 | | Yes |

| Treatment of vehicles in asset test6 | | Categorical eligibility and aligned to TANF cash assistance rules5 |

| Assets disregarded for eligibility determination7 | | No |

| Treatment of vehicles in asset test7 | | Excludes value of 1 vehicle per household |

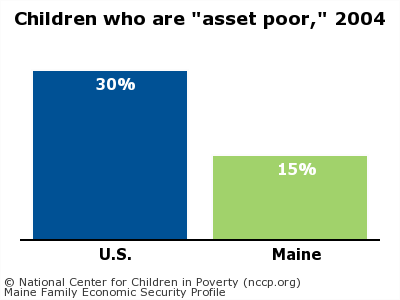

Children who are "asset poor," 20048

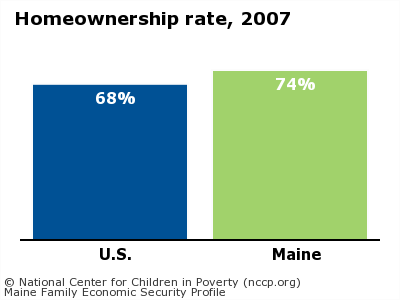

Homeownership rate, 20079

Data Notes and Sources

Data were compiled from 50-state sources. Some state policy decisions may have changed since these data were collected.

- Community-based IDA programs are operating in all states but often without state support. Also, in some states without state-supported IDA programs, IDA legislation was passed but never implemented due to lack of state funding, or IDA legislation expired, and no new state support was allocated.

Center for Social Development, Washington University, "Summary Tables: IDA Policy in the States, Table 1," October 2006, http://gwbweb.wustl.edu

- Maine's asset rules exempt $12,000 in certain savings, including retirement savings, for a household of 2 or more.

- Donna Cohen Ross and Caryn Marks. 2009. Challenges of Providing Health Coverage of Children and Parents in a Recession: A 50-State Update on Eligibility Rules, Enrollment and Renewal Procedures, and Cost-Sharing Practices in Medicaid and SCHIP in 2009, Kaiser Commission on Medicaid and the Uninsured. http://www.kff.org (accessed February 16, 2009).

- Rule applies to SCHIP-funded Medicaid expansions, where applicable.

Donna Cohen Ross and Caryn Marks. 2009. Challenges of Providing Health Coverage of Children and Parents in a Recession: A 50-State Update on Eligibility Rules, Enrollment and Renewal Procedures, and Cost-Sharing Practices in Medicaid and SCHIP in 2009, Kaiser Commission on Medicaid and the Uninsured. http://www.kff.org (accessed February 16, 2009).

- Virtually all food stamp households in the state are authorized to receive a TANF-funded benefit that makes them categorically eligible for food stamps and thus exempt from the gross income and asset tests.

- Households in which all members receive TANF cash assistance or SSI benefits do not have to meet gross income or asset eligibility criteria. Most states also waive these criteria for recipients of certain other benefits; some states waive these criteria for nearly all applicants.

Center on Budget and Policy Priorities, "States' Vehicle Asset Policies in the Food Stamp Program," November 2006.

- Gretchen Rowe with Jeffrey Versteeg, The Welfare Rules Databook: State Policies as of July 2005, Assessing the New Federalism, The Urban Institute, 2006.

- Figure reflects the percent of children in households that have insufficient net worth to subsist at the federal poverty level for three months in the absence of income.

Corporation for Enterprise Development, Assets and Opportunity Scorecard, http://www.cfed.org (accessed February 25, 2008).

- Figure reflects the percent of households who are homeowners.

U.S. Census Bureau, "Housing Vacancies and Homeownership, Annual Statistics 2007, Table 13," http://www.census.gov (March 14, 2008).